THE internal revenue bureau sees an increase in its collection of tobacco-related taxes as the number of registered firms engaged in the sale of cigarette, vape and other tobacco products more than doubled this year.

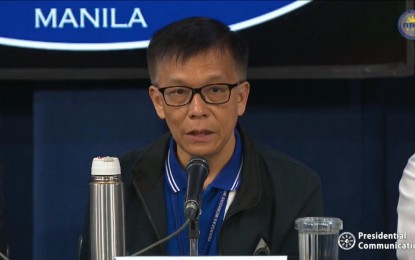

Bureau of Internal Revenue (BIR) Commissioner Romeo D. Lumagui Jr. said the increase in registered tobacco manufacturers, cigarette makers and vape sellers would help in boosting the government’s sin tax revenue.

Lumagui attributed the increase in registered taxpayers engaged in tobacco products to the various raids conducted by the BIR.

“It will be a huge help, because it means that they are paying their taxes. That is one of the good results of our raids,” he told the BusinessMirror in a recent interview.

“For example, after our raid on vape products, the number of registered vape sellers increased. That means if you are a registered entity, most likely—somehow—you are paying your taxes,” he added.

However, Lumagui pointed out that the government’s revenue losses due to illicit cigarette trade would remain bigger than expected increase in tobacco excise tax collections.

“The revenue we lose from illicit trade is still bigger. The increase in registered taxpayers would help mitigate that somehow,” he said.

Last month, Lumagui disclosed that the BIR is incurring as much as 20 percent in shortfall in excise tax collections with illicit tobacco trade in the country being one of the culprits.

The number of registered firms engaged in the sale of cigarette, vape and other tobacco products more than doubled to 103 from 45, latest BIR data showed. (Related story: https://businessmirror.com.ph/2023/05/23/no-of-bir-registered-tobacco-goods-sellers-doubled/)

Lumagui issued Memorandum Circular (MC) 57-2023 that listed the registered manufacturers, importers and exporters of various tobacco products as of May 15.

An additional 58 firms were added to the list compared to the previous list published by the bureau in June 2022, according to the annexes of the latest memorandum circular.

Last month, the BIR filed before the Department of Justice about 69 cases of tax evasion, amounting to at least P1.8 billion, against illicit cigarette traders caught selling untaxed, fake and smuggled cigarettes during the agency’s first simultaneous raids in January 2023 in different parts of the country. (Related story: https://businessmirror.com.ph/2023/05/26/bir-files- percentE2 percent82 percentA71-8b-worth-of-tax-evasion-raps-on-illicit-cigarettes/)

An earlier statement from the BIR read that the bureau’s tax collections from January to April reached P841.179 billion, 13.31 percent over the P742.37 billion it recorded in the same period last year.

“For the first four months of the year, the Bureau also managed to surpass its collection goal by 1.73 percent or P14.319 Billion,” the BIR said while attributing the increase in its revenue to more Filipinos filing income tax returns and paying correct taxes.

Image credits: Walter Eric Sy | Dreamstime.com