ELEVATED inflation and high interest rates will not dampen the country’s performance in the first quarter, according to the Bangko Sentral ng Pilipinas (BSP).

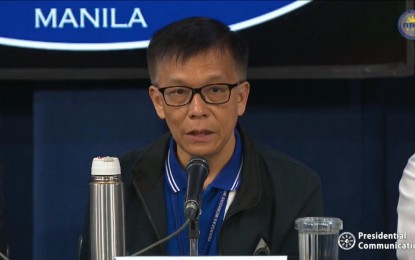

On Wednesday, BSP Governor Felipe M. Medalla told reporters that GDP growth may be around 6 percent in the January to March 2023 period. This is lower than the 8 percent posted in the same period last year.

“It will still be in the neighborhood of 6 [percent], lower than last year but not too much,” Medalla said. “Well, we never know, right? [My] experience with GDP is [it’s hard to] forecast. In fact, inflation is sometimes hard to forecast,” he added, in a mix of English and Filipino.

Medalla also said that while the Development Budget Coordination Committee (DBCC) retained the country’s growth targets, maintaining targets this year is not a problem.

However, Medalla said, 2024 may be “too far away” to determine whether the target should be maintained. He said one of the main reasons for this is high inflation here and abroad.

Medalla said sticky inflation in the United States may lead the Federal Reserve to continue its tight monetary policy. While the BSP is no longer keen on tracking the movements of the Fed, it will track inflation as it remains an inflation-targeting central bank.

“Some people are pessimistic about next year na very sticky ’yung inflation sa US, mabagal ’yung cuts and its very dangerous for the Philippine central bank to cut faster than the US even if it’s inflation is falling faster because the tendency of the markets to say ‘ay kailangan mas mataas ang policy rate ng Pilipinas kesa sa US’,” Medalla said.

“We may inherit the tight monetary policy of the US and if you’re pessimistic about the drop of inflation in the US, you would be pessimistic about the Philippine economy in 2024. But it’s too far away, it’s too far away,” he added.

Banks fit for shocks

MEANWHILE, Medalla said Philippine banks remain fit to withstand spikes in inflation, thanks to the lessons of the 1997-1998 Asian Financial Crisis. Medalla said efforts to address mismatches such as borrowing in dollars while earning in pesos have already been addressed.

He added that apart from mismatches, it is important to understand crises from a broader

context. Medalla said a number of crises could stem from “irrational exuberance.”

This happens when people invest or buy assets just because they think they can easily dispose of these assets, even if situations change.

It is therefore important, Medalla said, to be ready for any eventuality. He noted that the 1997-1998 crisis started in Thailand while the 2007-2008 crisis began in the United States.

“You don’t know where the shock will come from because the world is also too interconnected. One advantage of globalization is greater efficiency because you source your goods from the country that produces it at the lowest cost,” Medalla said.

“In essence everybody benefits. But then the world now is more interconnected. So in other words, being interconnected to the world has its benefits, it also has its concerns,” he added.

DBCC targets

LAST Monday, the Philippine economic team maintained its growth targets for 2023 at 6 percent to 7 percent while revising macroeconomic assumptions to reflect higher inflation and easing global oil price trends.

“The average inflation rate assumption for 2023 is increased to 5.0 percent to 7.0 percent from the previous assumption of 2.5 percent to 4.5 percent given the persisting high prices of food, energy and transport costs,” Secretary Amenah Pangandaman, who chairs the Development Budget Coordination Committee (DBCC), said.

“We maintained our growth targets at 6.0 percent to 7.0 percent for 2023 and 6.5 percent to 8.0 percent for 2024 to 2028 in consideration of the risks posed by geopolitical and trade tensions, possible global economic slowdown, as well as weather disturbances in the country,” Pangandaman said.

The Philippine economy grew by 7.6 percent in 2022, outperforming the DBCC’s growth target of 6.5 percent to 7.5 percent.

“This high-growth performance is projected to continue until 2028, aligned with the Medium-Term Fiscal Framework,” Pangandaman said as the 184th DBCC Joint Statement was issued.

Moreover, in line with the Philippine Development Plan (PDP) 2023-2028, the government will focus on modernizing agriculture, expanding agri-business, encouraging private sector participation in infrastructure development, promoting digital transformation, and enhancing the competitiveness of local industries, according to her.

By implementing the reforms and strategies already outlined in the PDP 2023-2028, Filipinos can expect a more robust Philippine economy with a single-digit poverty level.

Image credits: Junpinzon | Dreamstime.com