THE Philippines ended 2022 with an outstanding debt of P13.418 trillion, 14.4 percent over the P11.728 trillion recorded in end-2021, latest Bureau of the Treasury (BTr) data showed.

Historical Treasury data showed it was the Philippines’s highest end-December outstanding debt on record.

The country’s outstanding obligation at the end of last year was below the national government’s (NG) projected debt stock level of P13.43 trillion for 2022.

“For December, the [national government’s] total outstanding debt decreased by P225.31 billion or 1.7 percent from the end-November 2022 level, primarily due to the effect of local currency appreciation and the net redemption of domestic government securities,” the Treasury said in a statement on Thursday.

The Treasury said the NG’s debt-to-GDP ratio eased to 60.9 percent in end-December 2022 from 63.7 percent in end-September 2022. Furthermore, the country’s end-2022 debt-to-GDP ratio was lower than the 61.8-percent target under the NG’s medium-term fiscal framework (MTFF).

However, the end-2022 debt-to-GDP ratio was slightly higher than the 60.4 percent recorded ratio in end-2021, based on historical Treasury data.

“This reflects the consistent drive to bolster debt sustainability through prudent cash and debt management backed by resurgent economic growth,” the Treasury said.

Under the MTFF, the NG aims to bring down the debt-to-GDP ratio to less than 60 percent by 2025 and further down to 51.1 percent by 2028.

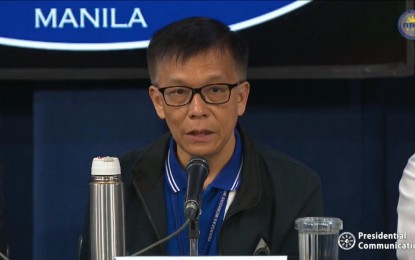

“Our medium-term fiscal plan and exemplary GDP growth have allowed us to outpace our borrowings. This gives us confidence that we can reach our targets by 2025,” Finance Secretary Benjamin Diokno said in a statement.

The NG’s domestic debt at the end of last year amounted to P9.21 trillion, 2.3 percent lower compared to end-November 2022’s value of P9.427 trillion due to the net redemption of government securities amounting to P217.95 billion.

“Moreover, local currency appreciation against the US dollar trimmed P1.63 billion from the peso value of foreign currency-denominated domestic debt,” the Treasury said.

However, end-December domestic debt, which accounted for 68.62 percent of total debt stock of NG last year, was 12.7 percent higher than the P8.17 trillion recorded domestic debt in December 2021, based on BTr data.

Meanwhile, the NG’s external debt in end-December 2022 fell slightly to P4.21 trillion from P4.216 trillion in November 2022 because of the impact of currency adjustments on foreign currency debt valuation.

“This offset the net impact of third-currency fluctuations against the US dollar amounting to P34.07 billion and the P18.54-billion net availment of foreign loans,” the Treasury said.

However, Treasury data showed the NG’s external debt in end-December 2022 rose by 18.3 percent from the P3.558-trillion level in end-December 2021.

The NG’s guaranteed obligations also rose by P11.05 billion month-on-month to P399.05 billion as of end-December 2022.

“For the month, the net availment of domestic guarantees added P26.19 billion while the net effect of currency fluctuations increased the value of external guarantees by P1.58 billion,” the Treasury said.

“This was tempered by net repayments on external guarantees amounting to P16.72 billion. However, compared to the end-December 2021 level, total NG guaranteed debt was lower by P24.87 billion or 5.9 percent,” it added.