THE rural banking sector is resilient enough to withstand the adverse financial impact of the coronavirus pandemic, a bank executive said.

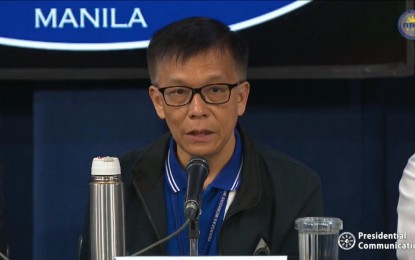

GM Bank Luzon Inc. President Tomas S. Gomez IV said during a webinar hosted by the Institute of Corporate Directors that rural banks, given their robust fundamentals, could overcome the current crisis.

“Like the banking sector in general, rural banks, as a whole, coming into this pandemic are well-positioned to absorb some pain and adapt,” said Gomez, who also served as president of Rural Bankers Association of the Philippines in 2008 to 2009.

The sector, he said, has sufficient capitalization, noting that capital adequacy ratio stood at 19.5 percent as of end-December 2019. This is nearly double the industry requirement.

According to preliminary data from Bangko Sentral ng Pilipinas, the entire Philippine banking system’s capitalization reached P2.35 trillion in April, which is 2.08 percent higher than P2.30 trillion a month ago and 8.9 percent more than P2.16 trillion the year earlier.

Gomez said the rural banks have a “good” liquidity ratio of 52.9 percent amid the pandemic.

“Therefore, depending on each bank’s risk appetite, there is ample cash to support businesses,” he explained.

He noted that rural banks also have been recording return on equity of 9 percent in the past couple of years.

Currently, Gomez said there are 447 rural banks with 2,810 branches across the country, 95 percent of which are located outside Metro Manila.

While rural banks are seen to be robust, the GM official said that they should still conduct impact assessment to identify the most affected sectors during the pandemic.

Gomez noted that, in general, the sector has the biggest exposure in the agricultural value chain.

“The bulk of our customers are small holder farmers, commercial farmers, traders, millers, input suppliers [and] food supply transport delivery,” he explained.

Despite financial constraints amid the pandemic, Gomez observed that some farmer-clients continued to pay their borrowings according to the deadline, not opting to defer even after the debt moratorium imposed by the government.

The same case was also noted for borrowers from the micro enterprise sector, he said: 40 percent to 50 percent were voluntarily paying their weekly or monthly amortizations shortly after the lockdown.

This, as business activities for the sector—including hardware, basic goods, junkshop and sari-sari stores—began picking up after lockdown eased, he added.

“At the same time, rural banks have little or no exposure to the most impacted businesses,” Gomez said, referring to airlines, bus companies, hotels, tourism and restaurants, among others.

“Given the general nature of the lockdown, which was focused on highly urbanized areas, the rural banking sector, I think, in terms of lockdown, did not suffer as much,” he added.

Rizal Commercial Banking Corp. (RCBC) President Eugene S. Acevedo, in the same webinar, agreed that the banks should be able to evaluate the severely impacted industries to minimize exposure.

Among these are real estate, manufacturing, transport, storage, construction, food services, accommodation and entertainment, he said. Banks should then be able to run various sensitivities to estimate the initial impact of the pandemic-induced crisis, he said.

Apart from this, the RCBC chief said that banks should be able to equip employees with much-needed skills as the banking sector enters the so-called new normal.

1 comment