THE Monetary Board (MB) slashed the interest rates of Bangko Sentral ng Pilipinas (BSP) for the second time this year to inject liquidity into the economy and temper the ill effects of the coronavirus disease 2019 (Covid-19) pandemic.

The BSP announced on Thursday that its overnight reverse repurchase (RRP) facility was reduced by 50 basis points (bps) to 3.25 percent, bringing the lending and deposit rates to 3.75 percent and 2.75 percent, respectively. The policy rate cut is effective beginning March 20.

The MB had also cut RRP by 25 bps to 3.75 percent. To date, the policy-making board has slashed policy rates by a total of 75 bps.

Last year policy rate was reduced by a total of 75 bps to 4 percent.

“The Monetary Board noted that while the enforcement of quarantine measures could help in slowing the spread of the virus, the resulting disruptions to industries and private spending are likely to reduce economic growth in the near term,” said the BSP.

The BSP noted that this could then slow down tourism, trade, overseas Filipino workers’ remittances and foreign investments.

“Given these considerations, the Monetary Board decided that there is a need for a follow-on monetary-policy response to address the adverse spillovers associated with the ongoing pandemic,” it said.

The trimming of policy rate was also supported by a “manageable” inflation environment, the BSP said, noting that this allowed the MB to have enough room for another cut.

The BSP maintained its inflation forecast of 2 percent to 4 percent, with average consumer price growth settling at 2.2 percent this year and 2.4 percent in 2021.

The latest projections were lower than the 3 percent for 2020 and 2.9 percent for 2021 announced last month due to “lower-than-projected inflation outturns in recent months, a sharp decline in global crude oil prices, and the adverse effects of the [Covid-19] on global and domestic economic activity.”

In February inflation decelerated to 2.6 percent from 2.9 percent a month ago due to lower transport and utility costs, the Philippine Statistics Authority reported. Average inflation stood at 2.8 percent in the first two months.

‘Expected’

Analysts welcomed the policy-rate cut, noting that it was expected given the current economic slump due to the pandemic.

“This will help counter the impact of the economic disruptions posed by the Covid-19 spread locally.… The monetary policy-rate cut is a great move in the right direction,” said UnionBank chief economist Ruben Carlo Asuncion.

With Covid-19 still bringing uncertainties, Asuncion urged the BSP to always be ready in coordinating both monetary and fiscal strategies.

“Given the imminent downturn in economic activity and the softening of the inflation outlook due to the drop in global crude oil, the BSP was afforded even more scope to cut policy rates,” ING Bank Manila chief economist Nicholas Antonio Mapa added.

He said the BSP should provide more measures to boost liquidity, including lowering the term deposit facility volumes and reducing the reserve requirements.

RCBC chief economist Michael Ricafort said the regulatory relief could boost loans and confidence in financial markets which are currently spiraling down due to negative sentiments amid the pandemic.

He said that there was still enough leeway for further policy-rate cuts should inflation continue to slow down because of decreasing global oil prices.

Easing of regulations

The MB also allowed the “time-bound, temporary relaxation of BSP regulations on compliance reporting by banks, calculation of penalties on required reserves, and single borrower limits.”

The BSP said it would also consider recalibrating its interest-rate corridor settings, cutting reserve requirement rations, holding off term deposit facility auctions and ensuring access to rediscounting windows.

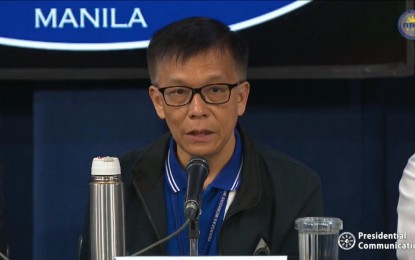

Image credits: Recto Mercene