TWO Senate committees are expected to open next week a review of the foreign loan agreements forged by the Duterte administration for dozens of projects, and the head of the Economic Affairs panel said on Sunday they will be looking for provisions that could partake of a “debt trap” as feared by critics, especially of China loans.

Sen. Sherwin T. Gatchalian said he expected the review, however, to be expedited by the move of the Department of Finance (DOF) to upload online two days ago all accords covering the Duterte administration’s flagship projects, including controversial ones like the Chico River Dam and the Kaliwa Dam.

Gatchalian confirmed the review starts next week even as “we are still internally vet- ting the documents uploaded by the DOF.”

He praised the latter for boosting transparency and allowing independent analysts to do a “real-time” review of the fine print that could lead to problems later.

The Economic Affairs Committee chairman indicated that the Senate review is meant to avoid what was feared to be a China debt trap.

“If borrowers don’t pay, what happens?” he asked aloud, alluding to cases of other debtor nations that were stuck with unconscionable terms that resulted in “surrendering” a part of their “assets or sovereignty.”

This, even as Gatchalian said the “Philippines is quite mature in public finance” mainly because of three things: Congress reviews loan agreements even though its prior consent is not required;

There is an independent Monetary Board that also reviews loan agreements; and macroeconomic data is also open to the public, which allows analysts to review data in real time. These things may account for the credit report rendered in late 2018 by research firm Nomura, describing the Philippines as “one of the more healthy countries in debt contracting,” according to Gatchalian.

He hailed the DOF for uploading the loan documents that are now open for public scrutiny.

Gatchalian disclosed over the weekend that the Economic Affairs Committee is “doing [an] internal review of the loan documents” prior to the opening of the Senate hearing, which he expected to be joined by the Ways and Means panel, chaired by Sen. Juan Edgardo Angara. “We’re doing our own internal due diligence,” Gatchalian added.

“We are [also] reviewing the terms in other loans where there are arbitration proceedings…We need to review if there are unfair terms,” the senator added.

Pressed for an example, he said there may be provisions “related to sovereignty and arbitration that may require tying up the West Philippine Sea.”

“There should be none of that,” added Gatchalian. The Philippines has closely studied the cases of countries that went into a so-called debt trap over Chinese loans, and should learn to avoid tricky loan provisions, the senator said.

Those countries, Gatchalian said, were either caught in “unsustainable borrowing” activities—meaning, their economy cannot sustain their level of borrowing—or they consented to an unfair “collateralization or surrender of their assets or sovereignty.”

Debt service data healthy

Relatedly, Action for Economic Reforms Coordinator Filomeno Sta. Ana III believes there is no cause for alarm that the country will face a debt crisis.

“Philippine debt service ratios indicate creditworthiness,” Sta. Ana said. “Fiscal situation has greatly improved, bolstered by the tax reforms that have generated sustainable revenues. That’s why we have maintained a positive investment grade from credit-rating agencies.”

Loan conditions also feature low interest rate in comparison to the country’s rate and other rates of most creditor countries, he said.

While Japan offers lower interest rate, he said it is difficult to compare it with that of China as it would be like comparing apples and oranges unless there is sufficient information that Japan offered the loan for the project with the same specifications.

“Moreover, we have to study other documents regarding the technical analysis, including cost-benefit to determine whether project is sound in economic/development as well as financial terms,” he said.

DOF knows its job–Neri

For former Socioeconomic Planning Secretary Romulo Neri, the terms on the loan agreements are “not onerous.”

“I’m sure DOF knows what it’s doing. What matters is we maximize the economic return on the project so the benefits exceed the costs, including loan repayments. Neda’s [National Economic and Development Authority] job is to ensure that so that we don’t end up with white elephant projects,” Neri said in a message to the BusinessMirror.

The government must also make sure that only first-rate Chinese contractors will be allowed. He added the implementing agency such as the Department of Public Works and Highways is also responsible for implementing expeditiously the projects and making sure that these will be done as planned.

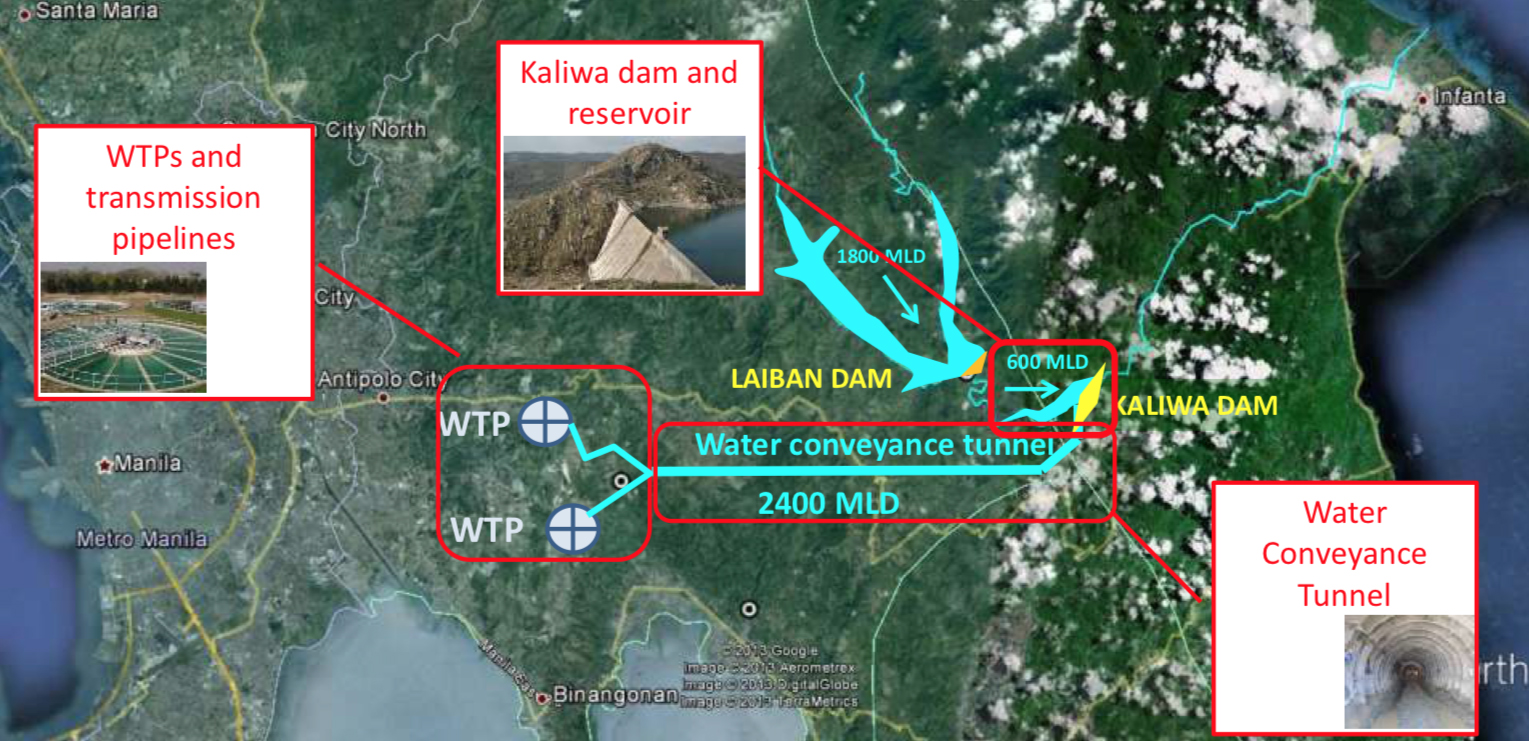

Image credits: MWSS