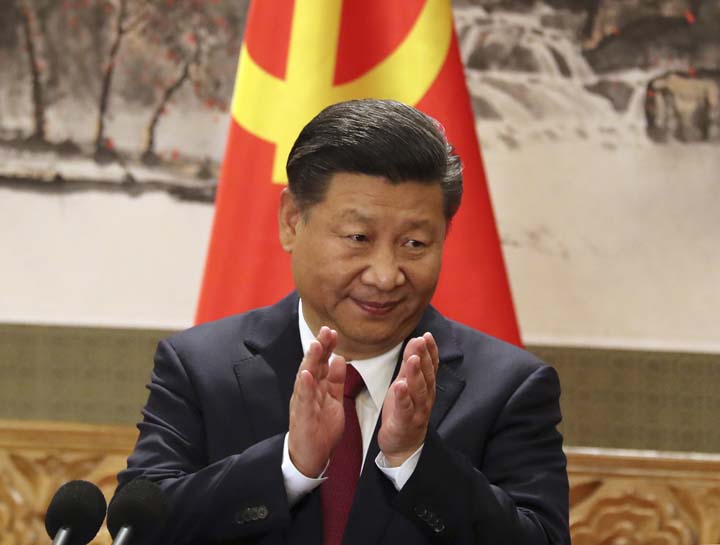

The removal of presidential term limits should guarantee one thing for investors—their China portfolios will be increasingly tied to one man.

Markets initially welcomed China’s plan to change its constitution on Monday, a move that would allow Xi Jinping to rule beyond 2023. Analysts say the political certainty should be largely positive for Chinese assets as it bolsters the president’s ability to drive through policies, such as those related to the deleveraging and antipollution campaigns. The absence of checks and balances, though, raises the risk of policy errors.

Xi’s term since 2013 has been marked by a mostly steady economy but also periods of volatility in the financial markets, typically triggering government intervention. Challenges loom, too, including taming the towering debt pile, the threat of slower economic growth and dealing with the aging population.

Further centralizing power under Xi is broadly positive from an investor standpoint, said Arthur Kroeber, founding partner at Gavekal Dragonomics in Beijing. But the longer-term risk is that “this lack of accountability, this lack of checks, could lead to a deterioration in the quality of decision-making at the top,” he said.

While the proposal wasn’t entirely surprising, it marks a formal break from the party’s succession practices and tradition of collective leadership. Sunday’s announcement comes a week before the National People’s Congress, when a series of constitutional changes cementing Xi’s influence are likely to be approved.

The yuan rose 0.4 percent on Monday as risk appetite strengthened and the greenback fell. The Shanghai Composite Index climbed 1.3 percent, its sixth straight session of gains.

Here’s what analysts are saying about the move to abolish term limits:

Raymond Yeung and Betty Wang, economists at Australia & New Zealand Banking Group Ltd., wrote in a note:

The proposed amendments to the constitution will ultimately shape all economic policies over the next decade or so, including fiscal and monetary policy. Wage growth, financial stability or the environment will be as important or even more important than annual gross domestic product growth. Downplay the 2018 GDP forecast provided by Premier Li Keqiang at the NPC on March 5 as it will carry a lot less weight as a policy goal. The focus will be on money supply and total social financing as they’ll have a direct bearing on debt control, and hence financial stability.

Ken Cheung, senior Asian currency strategist at Mizuho Bank Ltd. in Hong Kong, said in a note:

Further power consolidation by Xi suggests smoother delivery of structural reforms in the short-term. A stronger leadership would help him tackle the obstacles on the reform delivery. However, the potential shift from collective leadership to sole leadership signals increased policy-mismanagement risk and the lack of transparent system in power transition points to increasing political risk, which could undermine market confidence on the yuan in the medium term.

Analysts at Everbright Sun Hung Kai Co. said in a note:

Xi staying on beyond the two-term limit shouldn’t alter policy direction, but underlines the

commitment to carry it through. China has been very specific in its policy-making plans this year. Key tasks include preventing systemic risk, targeted deleveraging and reducing credit flows to undesirable areas. From an investment perspective, the best way to play this is to buy large domestic banks. They benefit from a large deposit base, meaning they’re less affected by the government’s risk-prevention policies.

Banny Lam, head of research at CEB International Investment Corp. in Hong Kong, said by phone:

The possibility of Xi ruling for a longer term will have a positive impact on Chinese markets: the Xi put will likely continue. China is still only half-way through reforms and economic transformation, so policy continuity is very important. A longer term for Xi would ensure more supply-side reforms and deleveraging efforts, as well as stable fiscal and monetary policies. That will help economic fundamentals and lift market momentum.

Robert Carnell, chief economist and head of research, Asia-Pacific, at ING Bank wrote in a note:

While most of the stories on this have focused on growing authoritarian tendencies in China, there is another way to view this—and that is on China’s ability to get things done. The deleveraging push, transition to a more consumption-based economy, the Belt and Road initiative, a more flexible capital account and currency, and anti-graft measures are more likely to be successful with a strong and steady leadership. The ability to get stuff done is something that the weak coalitions that govern, for example, most of Europe, would give their eye-teeth for. By all means, lament the lack of political debate in China, but from an investment perspective there are some upsides.

Pauline Loong, managing director at research firm Asia-Analytica in Hong Kong, said by phone:

The differences will not filter through to financial markets in ways that you can predict and act upon. In terms of policy, the Chinese government will continue to change market structure and rules to make the financial system more stable because now there’s a lot of stress and potential instability. The government will change everything in order to do that. In China market forces are advisories—if it’s to the benefit of the nation as seen by the government, it will be allowed to go ahead, if not, it has no space.

Tommy Xie, economist at Oversea-Chinese Banking Corp. in Singapore, wrote:

The departure from established norms may raise concerns among some Western investors as to whether China will dial back its political and economic reform. It’s unlikely to derail China’s commitment to open its market.

Image credits: AP