European banks are generally safer and stronger than they were when the European Central Bank (ECB) stepped in as the pan-continental financial supervisor three years ago.

Don’t wait for the applause.

Instead, financial professionals describe the watchdog as murky, beholden to national interests and late to the party in its first stretch on the job. A Bloomberg survey of 39 academics, analysts and fund managers give the regulator little more than a passing grade for its work so far.

The ECB’s efforts so far are seen by many as too little too late given that Italy’s biggest bank nationalizations since the 1930s happened on its watch. As the central bank prepares to take on more responsibility, with firms shifting operations from the United Kingdom after Brexit, its track record suggests the ride could be bumpy, and investors won’t always get the clarity they want.

“The ECB should have tackled problems like bad loans far sooner; the issue has been clear for all to see for a decade,” said Lutz Roehmeyer, who helps manage €13 billion ($16.1 billion), including European bank stocks and bonds at LBB Invest. “The fact that they didn’t is rooted in the national approach that we can’t quite shake in Europe.”

Daniele Nouy, who leads the ECB’s supervisory board, rejects the perception of the Single Supervisory Mechanism, the watchdog’s official name, as being “burdened or prevented from acting” by national interests. European banks have more capital and less bad debt than when the central bank started to oversee them, she said. A spokesman for the SSM declined to comment for this article.

The numbers back Nouy up. A key measure of financial strength, the common equity Tier 1 ratios of the euro area’s 21 biggest publicly traded banks rose to 12.9 percent on average at the end of September from 10.8 percent three years earlier, data compiled by Bloomberg Intelligence show. Nonperforming loan (NPL) ratios have also fallen, especially in Italy where the bad debt was weighing on the entire economy.

Respondents to the Bloomberg survey agreed that the ECB has made European banks safer, although many also credited stricter global capital rules put in place after the financial crisis.

“Tackling NPLs is a journey, a journey that started in 2014” and has seen the ECB take further action, Nouy told reporters in Frankfurt on Wednesday. It’s human nature that the hardest-hit banks and countries are the most vocal critics, she said.

Last October the supervisor followed up guidelines on how banks should tackle NPLs with suggested provisioning deadlines for bad debt. The proposal sparked a barrage of criticism, especially from Italy, and the ECB was forced to postpone it to assess the feedback. The so-called addendum is due to be finalized next month and could take effect as soon as the start of April, Nouy said.

European leaders agreed to use a wide-ranging asset quality review in 2014 to ensure their country’s banks entered ECB supervision in good health. Jutta Urpilainen, a former Finnish finance minister who helped establish the supervisor, said she doesn’t know if that worked.

“The aim was to truly X-ray the banks,” said Urpilainen, who is still a member of the Finnish parliament. “The starting point had to be that the problems were genuinely dealt with. It’s hard to assess whether we were perfectly successful in our aims or whether uncertainty over the nonperforming loans remains.”

Monte Paschi

The poster child of Europe’s bad-loan problem is Italy’s Banca Monte dei Paschi di Siena SpA, which was rescued for a third time after the Italian government used a loophole in European law to inject taxpayer funds last year.

ECB President Mario Draghi led the Rome-based central bank from the end of 2005 until 2011, a period during which troubles started to build up at the lenders.

Monte Paschi’s latest rescue was only possible because the ECB declared the bank solvent, even after a drop in deposits raised concerns about its short-term funding. That hurt the supervisor’s reputation, said Klaus Fleischer, a professor of finance at the University of Applied Sciences in Munich.

The ECB could also have done a better job explaining why Banco Popular Español SA’s funding dried up in 2017, said Jean Dermine, a professor of banking and finance at INSEAD business school.

The Italians aren’t alone. German officials acknowledge in private that they would be tempted to skirt European rules if one of the country’s top banks needed a bailout.

National priorities

National interests also show in Europe’s treatment of smaller banks, where direct supervision is up to domestic authorities. Germany, home to Europe’s largest number of small banks, has long suffered from comparatively low profitability in a fragmented market that has been exacerbated by low—and sometimes negative—interest rates. Almost 5 percent of small and medium-sized German banks missed regulatory capital requirements in a stress test conducted by Germany’s two top financial watchdogs.

Nouy’s colleagues also rejected their portrayal as a divided board and said that different backgrounds improve the quality of oversight.

“You have really experienced supervisors at the table,” said Madis Muller, a member of the board and a deputy governor of the Estonian central bank. “They have different views and would probably treat something differently in a national decision. But, being at the SSM, we have to agree and treat banks the same way.”

Crisis response

IN 2013 European leaders sought to respond to the financial and sovereign debt crises that shook confidence in banks, regulators and states alike. The ECB’s credibility and legal authority meant it was best-placed to step in and oversee euro area lenders.

That doesn’t mean banking supervision has to stay at the ECB, said Joerg Asmussen, a former ECB executive board member who is now a managing director at Lazard Ltd. “If there is a time for treaty change, we could set up a separate agency,” he said. “It works, there’s no operational risk if you split it now.”

If that happens, it probably won’t be on Nouy’s watch. Her five-year, nonrenewable term, ends this year. Does she have advice for her successor?

“To strongly adhere to the European mandate and European ideals,” she said. “To have enough vigor to handle banks and criticisms that go with the job. What else? Persistence to make sure that what is decided is implemented.”

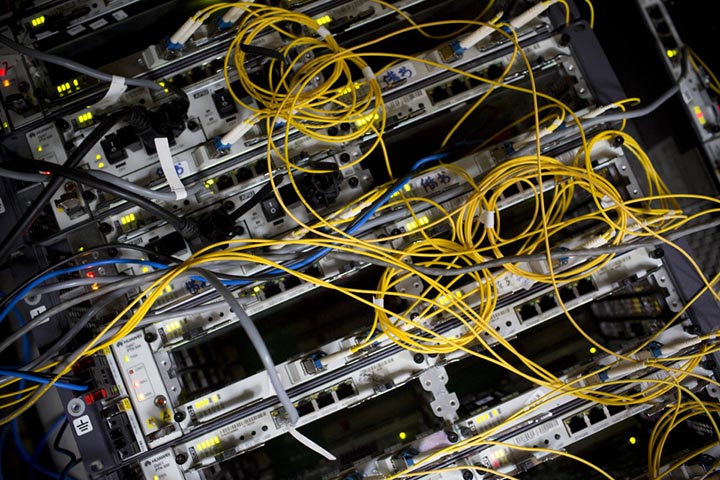

The ECB is also pushing banks to think about other threats from the possibility of cyber attacks to the disruption of their business models by financial-technology start-ups.

“They really delivered on setting up the institution,” said Anders Borg, who was Sweden’s finance minister when the ECB was preparing to take over banking supervision. “It remains to be seen whether we’ve done enough. The real test for the supervisory structures will be when we see the next financial crisis.”