Australia’s banks, rocked by years of scandals and wrongdoing, risk having further misconduct exposed as a powerful government-appointed inquiry into the nation’s financial industry starts.

The yearlong Royal Commission will examine the nation’s banks, insurers, financial-services providers and pension funds, and consider whether regulators have enough power to tackle misconduct. The first public hearings will focus on allegations of “inappropriate or unsuitable” consumer lending, counsel assisting Kenneth Hayne, a former High Court judge appointed to run the inquiry, said in Melbourne on Monday.

The hearings, expected to begin in March, will look specifically at lending practices in the big profit centers of mortgages, car loans and credit cards and whether consumers have been treated “honestly and fairly.”

Anger over bank conduct has grown as evidence of wrongdoing mounts—from rigging interest rates and ripping off customers, to allegations Commonwealth Bank of Australia breached anti-money laundering and terrorism financing laws more than 50,000 times—even as lenders rack up record profits.

“There is an endless buffet of complaints that people can raise,” said Andrew Schmulow, a law lecturer at the University of Western Australia who argues the banking system has failed and needs radical reform. “Unless the Royal Commission finds that there is nothing wrong, which is inconceivable, it will hand down recommendations, and it would be a brave government that ignores them.”

The cost to the banks won’t only be to their reputation. Commonwealth Bank last week took a A$200-million provision to cover the expense of regulatory probes—including the Royal Commission—and compensating customers. The inquiry is also set to focus on bank profitability. In a background paper published on February 9, the commission said the big banks have posted fatter profit margins and higher return-on-equity than smaller lenders, and Australian banks are comparatively more profitable than peers in Canada, Sweden, Switzerland and the United Kingdom.

“The cornerstone of the banks’ strong profits has been their ability to change prices for customer products, like interest rates on home loans or deposits, as they see fit,” David Ellis, banking analyst at Morningstar Inc., told Bloomberg Television, noting that any new restrictions on repricing would dent profitability.

“The drums are clearly beating louder that the profitability of Australian banking is under threat and can’t be sustained,” Citigroup Inc. analysts Craig Williams and Brendan Sproules wrote in a note last week. “Given the industry has fallen out of favor with its political and regulatory masters, it seems likely that there will be a material recasting of the economics of the industry.”

Potential repercussions from the inquiry include “financial penalties for mis-selling, refunds to customers, higher operational risk capital and a multitude of compliance expenses,” they said.

A Royal Commission is one of the most powerful independent judicial inquiries that can be held in Australia. It has the power to summon witnesses to produce documents or testify under oath. The recently completed commission into child sex abuse ran for almost five years, heard from nearly 8,000 witnesses, and produced a 17-volume final report containing 409 recommendations.

Prime Minister Malcolm Turnbull, who opposed a banking inquiry before bowing to pressure from renegade lawmakers within his ruling coalition, has sought to limit potential damage to the financial industry by imposing the 12-month deadline. Hayne will submit an interim report by Sept. 30, and his final report by Feb. 1, 2019.

The banks also bowed to the inevitable and embraced the inquiry. In a letter to staff last month, Australia & New Zealand Banking Group Ltd. Chief Executive Officer Shayne Elliott said his “hope is the Royal Commission serves as a watershed moment in restoring the trust of customers and the community.”

For their part, the banks say they have learnt their lesson and are already taking steps to fix problems, from compensating customers to changing pay structures to focus more on customer service and less on meeting sales targets.

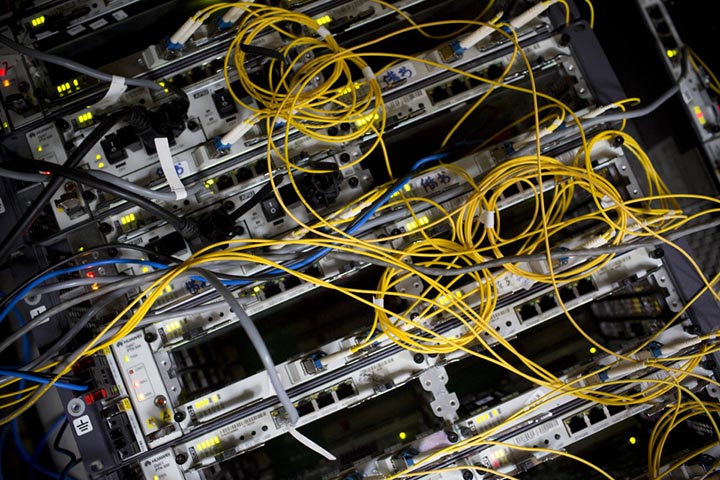

Image credits: Bloomberg